Atal Pension Yojana (APY) Statement or Status | apy balance status

Wondering what Atal Pension Yojana is and how to check its status? Allow us to walk you through a brief introduction of the Yojana and then we will talk about checking the status of APY and apy account statement.

How can I check APY Statement or Status

Basically you need to check whether your statement for Atal Pension Yojana online. Initially it was not possible but now you can. List is the step by step process

- Browse this url https://npslite-nsdl.com/CRAlite/EPranAPYOnloadAction.do

- if you know your APY Pran then click on “Click to search with PRAN”

- Enter your PRAN Number and Bank acount Number

- enter the captcha and press submit

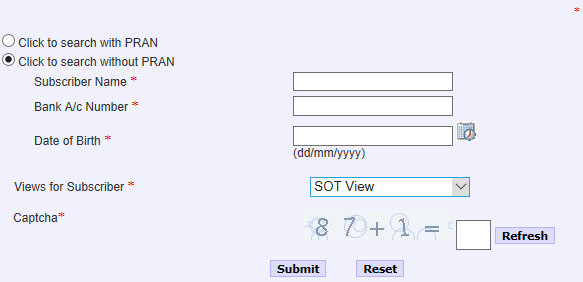

- If you do not know your PRAN then check “Click to search without PRAN”

- Enter your Name, Bank Account Number and DOB.

- Select e PRAN View or SOT view

- Enter the captcha and press submit button.

- Now you can download your apy statement.

So, what is Atal Pension Yojana?

As the name suggests, it a pension scheme. We can give you a boat-load of words to read but here is a quick summary:

- Anyone who is employed in India’s unemployed sector is not entitled for pension because employers there do not have pension schemes.

- This does not mean they cannot have a pension scheme of their own. They can buy it under APY.

- The pension scheme can be purchased by anyone in unorganized sector.

- The scheme buyer cannot stay outside the age range of 18 and 40 years (both numbers included).

- A monthly payment has to be made by the buyer till the point he or she reaches the unemployable age, which in India is considered to be 60 years.

- Once the purchaser reaches the age of 60, he or she can withdraw pension on a monthly basis depending on the amount of money he or she has been depositing.

How much pension will be paid per month?

There are 5 slabs to choose from. The minimum payout per month will be ₹ 1,000 and max payout will be ₹ 5,000 with ₹ 1K increment for each slab.

Which slab to choose?

That has to be decide by the purchaser of APY depending on his or her needs and the amount the person can afford to pay each month. However, there is a minimum monthly deposit floor. There is also a maximum monthly deposit ceiling. The minimum cannot fall below ₹ 42 and maximum cannot shoot beyond ₹ 1,454.

How much should I pay?

Well, this will depend on your age. Let us assume two scenarios:

Scenario 1: You are of age 18 when you purchase the APY. You want a monthly pension of ₹ 5,000. You have to pay for 42 years with a monthly contribution of ₹ 210.

Scenario 2: You are of age 40 when you purchase the APY. You want a monthly pension of ₹ 5,000. You have to pay for 20 years with a monthly contribution of ₹ 1,454.

So basically, you age and your final pension demand will determine the amount you need to pay.

Other Articles.